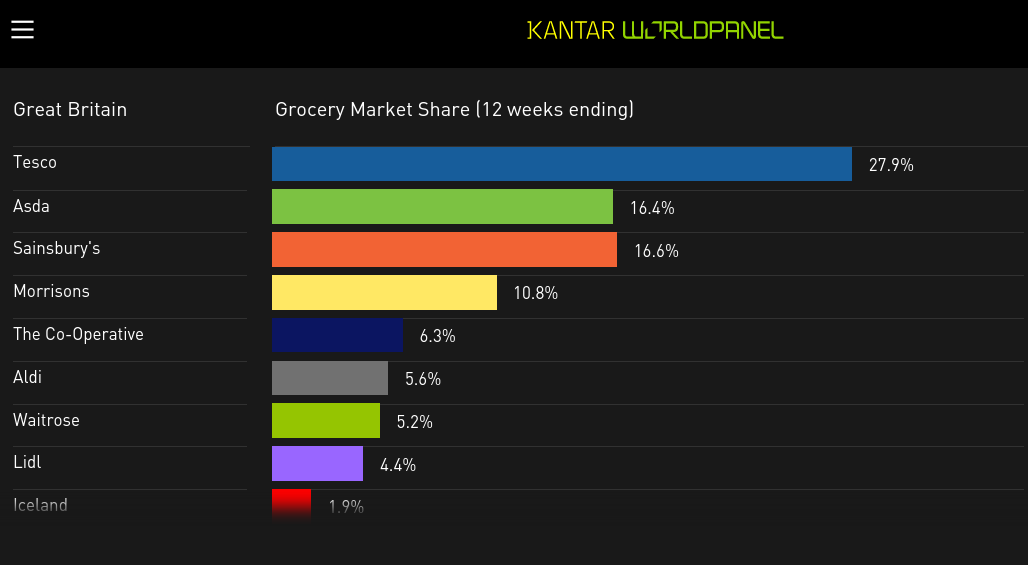

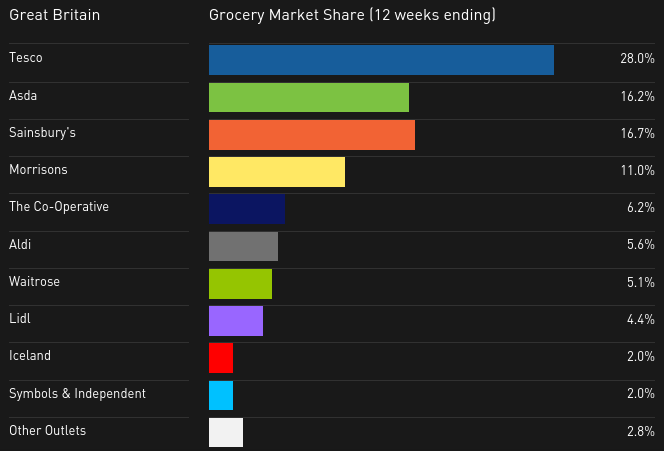

“Not much festive chair for supermarkets collectively this month with growth falling to a feeble 0.1%.” That’s how Fraser McKevitt, head of retail and consumer insight at Kantar Worldpanel, began discussing the company’s latest data on grocery share in the UK, covering the 12 weeks to December 6.

Furthermore, like-for-like prices had fallen by 1.9% in the previous month, he said.

But in among the gloom, Sainsbury’s was the stand-out performer. It boosted sales by 1.2%, growing across its convenience, supermarket and online businesses and increasing its market share to 16.7%.

Meanwhile it was a familiar story of falling sales and shrinking share for Tesco, Asda and Morrisons, but for Aldi and Lidl, one of double-digit growth and they “are surely looking forward to a record Christmas market share,” McKevitt said.

Listen to his analysis and read more here: http://www.kantarworldpanel.com/en/Press-Releases/Sainsburys-stands-out-in-the-run-up-to-Christmas