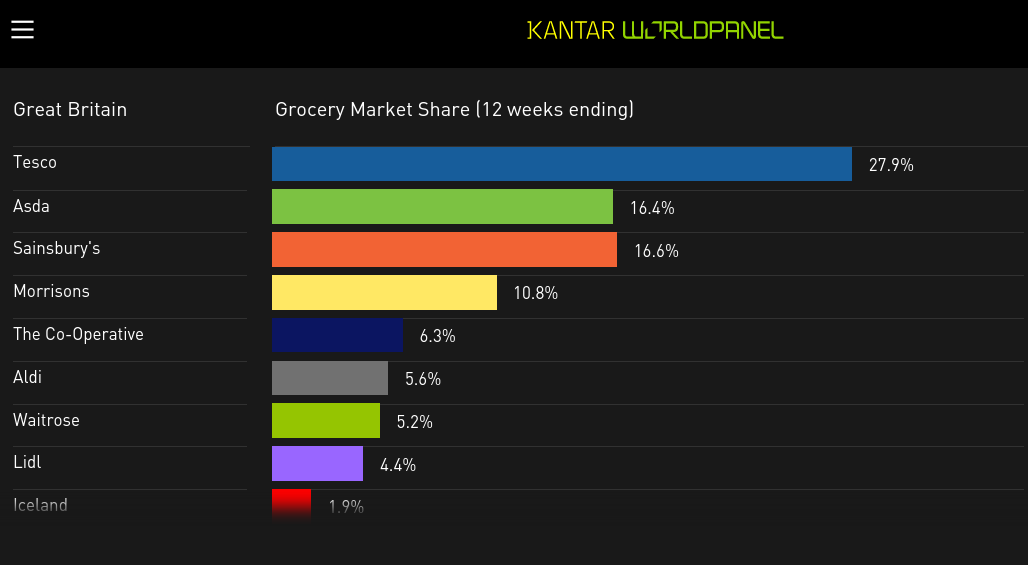

Discount retailers Aldi and Lidl have reached a combined 10% share of the British grocery market for the first time, new grocery share figures from Kantar Worldpanel reveal.

The data, for the 12 weeks to November 8, show Lidl’s market share reached a new record high of 4.4%, up 0.7 percentage points on last year thanks to 19% sales growth. Aldi grew sales by 16.5%, keeping its market share at 5.6% for the fifth consecutive month.

Fraser McKevitt, head of retail and consumer insight at Kantar Worldpanel, said the discounters show no sign of stopping and with plans to open hundreds of stores between them will further widen their reach to the British population.

“If you look back as recently as 2012, Aldi and Lidl only held a 5% share of the market, and it had previously taken them nine years to double their combined share from 2.5%. In the last 12 weeks the two retailers have attracted another additional million shoppers compared with last year while average spend per trip has increased by 4% to £18.85, which is 78p ahead of the total retailer average,” McKevitt said.

Other highlights from the latest data:

- Sainsbury’s: has seen its fourth consecutive period of growth despite the tough market, with sales up 1.5%

- Tesco: sales were down by 2.5%

- Morrisons: sales fell 1.7%

- Asda: sales dropped 3.5%

- Waitrose: sales up 2.7%

- The Co-operative: sales up 1.5% & a 0.1 percentage point gain in market share

Shoppers paying less

Grocery inflation stood at -1.7% for the 12 weeks to November 8, which means shoppers are now paying less for a representative basket of groceries than they did in 2014. “This is the same fall as reported last month. Falling prices reflect the impact of Aldi and Lidl and the market’s competitive response, as well as deflation in some major categories including eggs, butter, bread, crisps and fresh poultry,” Kantar Worldpanel reported.

sources

http://www.kantarworldpanel.com/en/Press-Releases/Aldi-and-Lidl-reach-10-per-cent-share-of-the-British-grocery-market-for-the-first-time

http://www.kantarworldpanel.com/en/grocery-market-share/great-britain