In 2014, Korea’s fruit consumption per capita, including imported fresh oranges, increased to 66.5 kg due to consumer preferences for more fresh fruit in the diet. However, over the last 10 years the consumption has still been below the international recommended quantities. A sharp decline is noted in consumption of the locally produced ‘Singo’ pears, which were also exported to the U.S. in the past.

Korea’s fruit imports have increased steadily after implementing many free trade agreements (FTAs) since 2003. Its nine major fruit imports, including oranges and table grapes, increased by 4% (24,000 tons) to 615,680 tons during the first 10 months of 2015 compared to the same period in 2014.

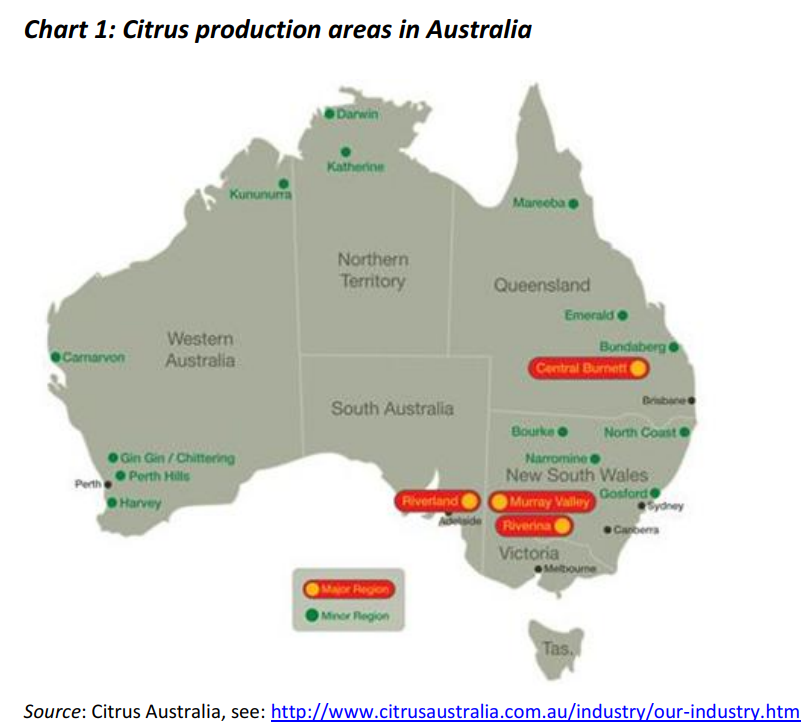

In 2016, Korea is still imposing a 10% seasonal tariff on U.S. fresh oranges from March to August under the KORUS FTA; the tariff will be eliminated in 2018. In the marketing year 2015/16, fresh orange imports are expected to increase by 7.5 percent to 120,000 tons, a 9,000 ton increase on the previous crop year, mainly due to the end of the west coast port strike in the U.S. and improved quality for this year’s fruit. The U.S. is the major orange supplier to the Korean market with a 93% market share in the sales year 2014/15, followed by South Africa and Spain with 4% and 2% respectively.

This article appeared on page 18 in the News section of edition 141, Jan/Feb 2016, of Eurofresh Distribution magazine. Read that issue online here.

South Korea flag image: by various [Public domain or Public domain], via Wikimedia Commons