Italian retail seeking a new fruit and vegetable sector

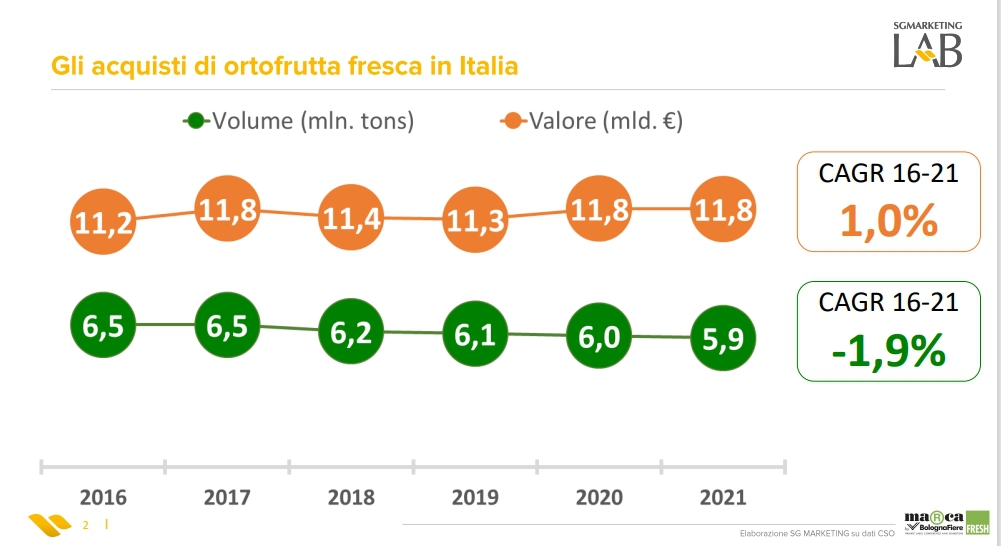

The conference presented data from a survey carried out by SG Marketing on a thousand buyers and consumers, which showed that new categories are gaining ground in the fruit and vegetable segments of the main supermarket chains. The last five years have seen a drop in fruit and vegetable consumption, which is now being componded by external factors such as the Covid-19 pandemic, the war in Ukraine and the increase in cost of raw materials across the entire supply chain, all of which is conditioning the choices made by the public.

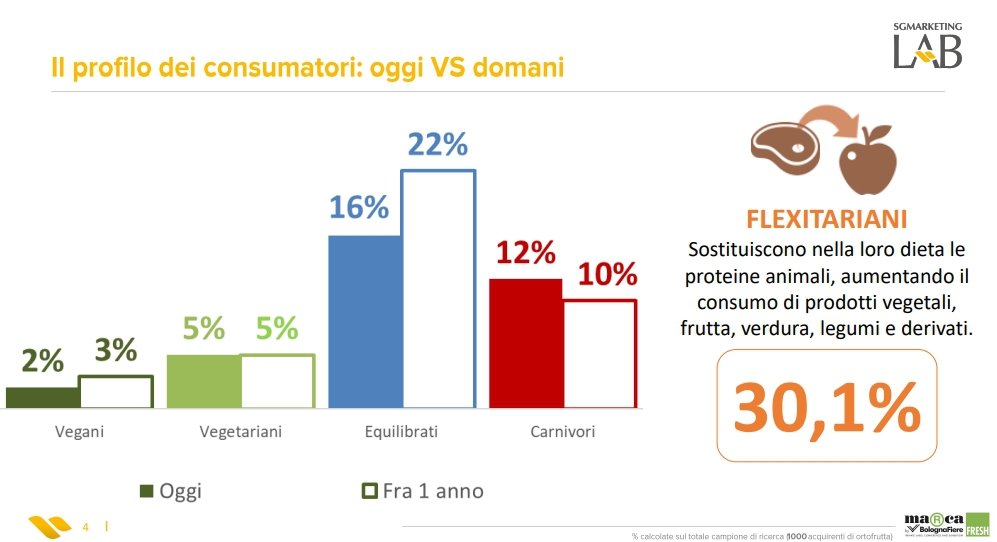

The largest consumer segment? Flexitarians

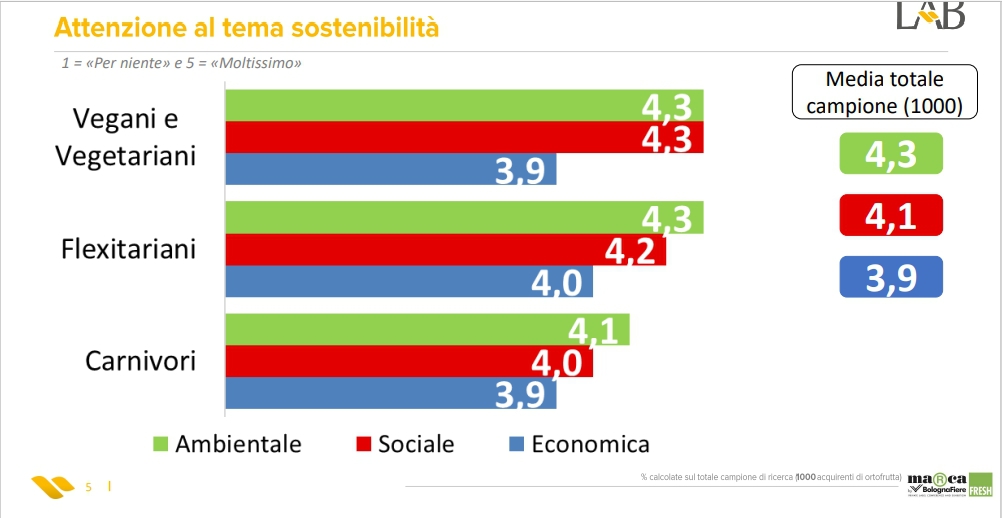

The biggest group in the survey sample consisted of flexitarians (30.1%), which means consumers who tend to favour the consumption of vegetable proteins over animal ones. Next comes those who follow a balanced diet (16%) and carnivores (12%), while vegetarians (5%) and vegans (2%) remain marginal. It is the first two segments (i.e. those aiming to replace animal proteins with vegetable proteins) that Italian retail must look at with increasing attention. Anoher element that emerged from the study was continued interest in the topic of sustainability.

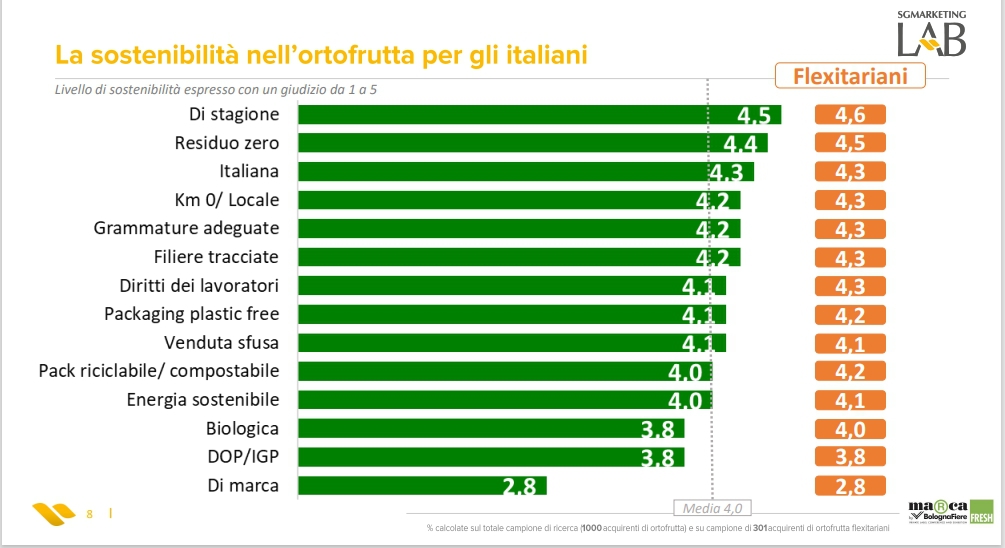

Customers prefer seasonality, sustainability and short supply chains

Among the factors that consumers favour, on a scale from 0 to 5, are seasonality (4.5), local (4.2) or national (4.3) origin, and certified guarantees of zero residues (4.4) and supply chain traceability (4.2). Another issue to emerge is consumer sensitivity towards the problem of food waste, not only through plastic-free, recyclable or compostable packaging, but also by providing suitably sized formats.

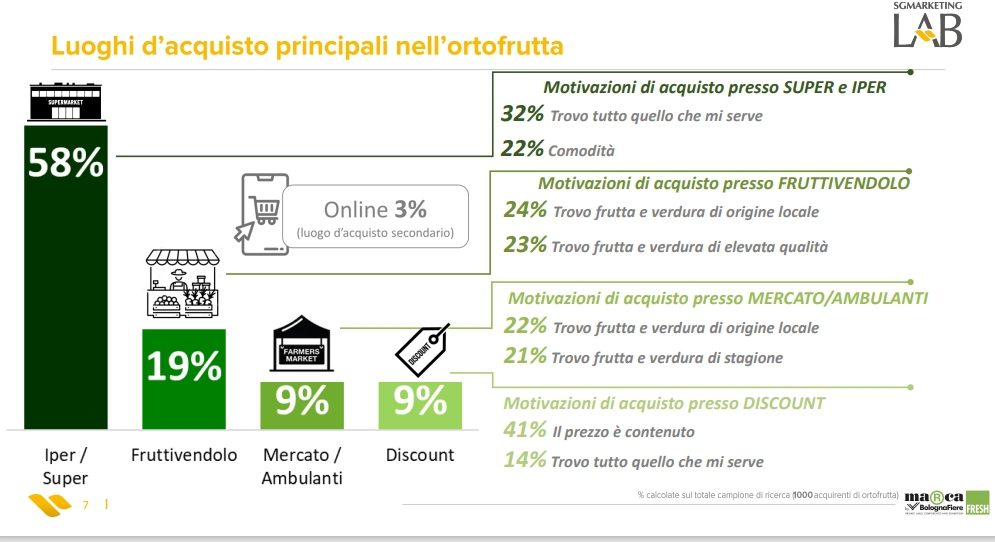

The relationship between preferred distribution format and purchasing value is also of great importance: the 9% who prefer the discount formula are attracted by the more affordable prices on offer there, while the vast majority (58%) who focus on supermarkets and hypermarkets are essentially driven by the breadth of the assortment and the convenience that this entails. The small retailers, shopkeepers or street vendors, on the other hand, are the choice of 28% of the sample, who see them as guarantees of freshness, seasonality and product origin. There are also 3% (and growing) who are now looking online, albeit not as their main channel.

Communicating about origin and supply chain

Last, but not least, is the need to communicate relevant information about fruit and vegetables. While there is customer satisfaction about the information provided about product origin, the same cannot be said about production methods and supply chain traceability, both of which the customer is increasingly keen to know about.