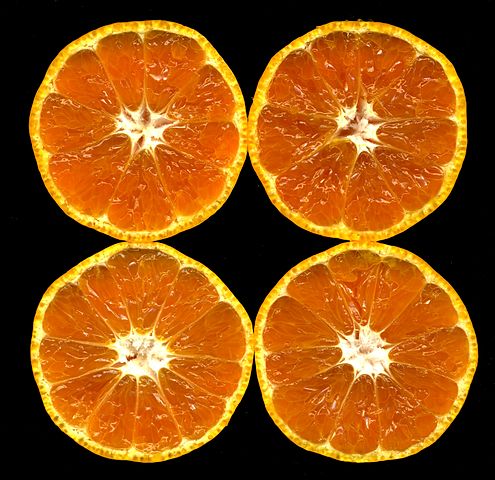

The Japanese are eating less mandarins and more lemons, a USDA report on citrus in Japan reveals.

Since 2003, Japan’s annual household consumption of all fresh fruit has dropped 15% – from 97–82kg – but the rate of decline for mandarins has been greater – 30%, to 12.3kg, the report “Japan: Citrus Annual” says.

Prepared by the Global Agricultural Information Network (GAIN), it says the drop in mandarin consumption may be the result of increased availability of other fruit varieties.

Other possible reasons cited are that Japanese consumer preferences have been shifting towards fruit that is not tart or tangy, and younger Japanese tend to eat less fruit which requires peeling.

However, mandarins remain one of the most popular fresh fruits in Japan, accounting for about 15% of fresh fruit consumption there in 2013.

“The Japanese industry has been trying to encourage consumers, particularly younger consumers, to purchase more mandarins by introducing ready-to-eat mandarin products such as cut fruit and jelly-fruit cups.”

“Japanese production, consumption and imports of mandarins are forecast to decline further in MY 2014/15, as farmers continue to exit and consumers substitute other fruits and sweets for mandarins,” it says.

Increased lemon demand, production

Meanwhile, total numbers remain small but increased Japanese lemon production reveals underlying consumer preferences and shifts within Japanese citrus production, the USDA says.

“Growers seeking a higher return on their investment are substituting mandarin trees with different citrus tree varieties such as lemon.”

Unlike other fruit harvesting farms in Japan, the area harvested for Japanese lemons has been growing steadily over the last decade as Japanese growers respond to this increased consumer preference for local lemons.

It’s anticipated the 2014/15 campaign will see Japan’s lemon harvest area expand to 500 hectares with production volume slightly increasing to 10,000 MT – up 5% on current production estimates of 9,500 MT.

in Japan, fresh lemons are mainly used by the food service sector, as a garnish or food and beverage ingredient.

“Domestic lemon producers have aggressively promoted the freshness of their produce, as well as introducing some recipes online, and these efforts have slowly increased consumer demand.

Additionally, domestic lemon producers have been targeting safety-cautious consumers by advertising their produce as free of postharvest agrochemicals.”

“In MY2013/14, imports from New Zealand increased to 819 MT. New Zealand lemons fill into the market when Chilean and U.S. lemons are out of season. They are marketed as free of postharvest agrochemicals and sold at a premium price.”

Overall, the impact of citrus greening disease in Florida, tight global fresh orange supplies, a weaker yen and increased competition from substitutable products for Japanese consumer dollars should drive grapefruit, orange, and orange juice imports lower in the 2014/15 marketing year, the USDA predicts.

Read the report.

Image: “Citrus unshiu-unshu mikan” by Tomomarusan. Licensed under CC BY-SA 3.0 via Wikimedia Commons