The top organic fruit and vegetable exports by the US so far this year are apples, lettuce, grapes, spinach and strawberries, according to data updated today by the USDA.

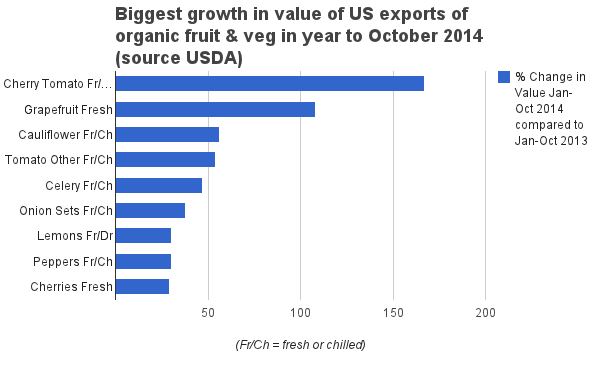

These are the products that lead in value for the ten months to this October, though the totals for apples and lettuce are down 22% and 11% respectively on the same period last year. In terms of the biggest growth relative to last year, cherry tomatoes, grapefruit, cauliflower, other tomatoes and celery are the top five items.

|

Organic item exported by US |

Value in Thousands of US$ |

% Change in Value Jan-Oct 2014 compared to Jan-Oct 2013 |

|

Apples Fresh |

91,856 |

-22 |

|

Lettuce Not Head Fr/Ch |

62,564 |

-11 |

|

Grapes Fresh |

42,831 |

2 |

|

Spinach Fr/Ch |

31,349 |

14 |

|

Strawberries Fresh |

27,966 |

11 |

|

Carrots Fr/Ch |

22,470 |

10 |

|

Cauliflower Fr/Ch |

21,681 |

56 |

|

Cult Blueberries Fresh |

16,968 |

16 |

|

Pears Fresh |

15,787 |

-7 |

|

Broccoli Fr/Ch |

13,267 |

-2 |

(Fr/Ch = fresh or chilled)

|

US organic export |

Unit of measurement |

Volume Jan-Oct 2014 |

% Change in Vol Jan-Oct 2014 on Jan-Oct 2013 |

|

Apples Fresh |

42LBC |

3,656,652.90 |

-21 |

|

Potatoes Fr/Ch Xsd Oth |

CWT |

68,434.00 |

-29 |

|

Cauliflower Fr/Ch |

MT |

22,249.80 |

61 |

|

Lettuce Not Head Fr/Ch |

MT |

21,681.90 |

-15 |

|

Grapes Fresh |

MT |

19,111.30 |

2 |

|

Carrots Fr/Ch |

MT |

16,744.80 |

8 |

|

Onion Sets Fr/Ch |

MT |

14,900.30 |

19 |

|

Pears Fresh |

MT |

13,828.40 |

1 |

|

Celery Fr/Ch |

MT |

10,707.00 |

100 |

|

Broccoli Fr/Ch |

MT |

10,159.50 |

-9 |

(Fr/Ch = fresh or chilled)