Health awareness – and huge distances – shaping changes in the country’s fresh produce supply

Blueberries, avocados and sweet potatoes are among the fastest-growing products in grocery stores under the umbrella of Norway’s giant BAMA Group, which has seen its turnover rise 9% on 2013 to an expected €1.65 billion this year.

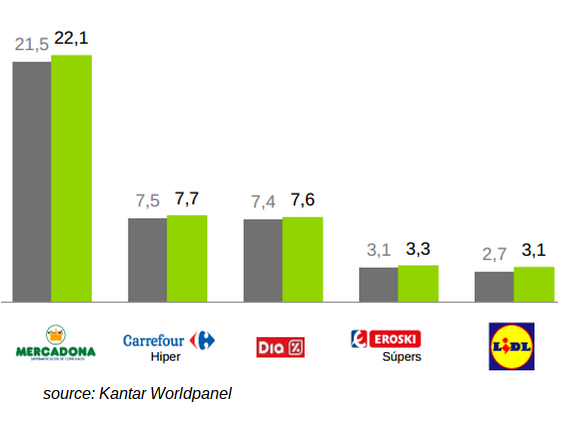

“But the competition is tough,” BAMA Group CEO Rune Flaen says of Norway’s highly concentrated retail sector, which recently shrank from being dominated by four major retail groups to just three.

With news in October that Norway’s large Coop chain will take over the Norwegian operations of Sweden’s ICA chain, that leaves just three main retail groups in Norway: NorgesGruppen (40%), Coop (32%) and Rema 1000 with partners (28%).

NorgesGruppen and Rema 1000 are shareholders of, and supplied by, BAMA.

Tough climate makes marketing crucial

High taxes and costs, protectionist food policy, and dominance by just a few wholesalers and retailers are among factors shaping retail in Norway and another key one, as Flaen said at the Fresh & Life berry symposium in Madrid in October, is distance.

Norwegians have the highest concentration of shops per inhabitant in Europe, mainly due to the challenging logistics in a country which measures 2000 km from from north to south.

“A large part of the European industry is struggling,” so marketing is even more crucial, he said. BAMA thus makes sales planning and marketing a priority and among its various initiatives is a large sport sponsorship program, where the aim is to encourage physical activity and a healthy diet through different activities for children especially, and Norwegians in general.

Berries, then tomatoes and bananas lead fresh produce value

Flaen – who has spent more than 30 years at BAMA and the last 20 at its helm –

said bananas used to be its most valuable fresh produce category but now it’s berries, tomatoes, then bananas. The berry category accounts for about 3% of Norwegian grocery sales in the summer peak season, far ahead of Coca Cola – something Flaen noted as “really important.”

In berries, strawberries still lead but raspberries have also become an important year-round item and blueberries have had “explosive growth”.

“There’s enormous potential in the berry sector in years to come,” he said.

In an interview with ED at Fruit Attraction, Flaen shared more market insights:

There’s been huge growth in BAMA’s berry sales. Where else is demand rising?

We’ve had big growth in avocados (+137 % last five years – volume) and in all root vegetables. For example the sweet potato market has exploded, sales last year tripled in volume after a marketing campaign teaching families how to prepare them. Mashed sweet potato has become a favourite for kids.

What’s driving interest in root vegetables?

More and more people going back to basics and cooking at home. We’re seeing that trend really strongly – sales are up 110 %.

What other trends are you observing?

Local produce is very popular, people are really interested in the region and history behind their food – that’s a clear trend for the future. Private labels will also grow.

What opportunities are on the horizon for fresh produce suppliers?

The health trend is very strong. We have to find the right products for consumers and inform them about what’s in them nutrition-wise and what they do to their bodies – that’s the big trend.

Are health benefits behind the explosion of blueberry consumption in Norway?

Mainly but also because we now have good quality and availability year-round – that’s the key to growth.

What is one of your priorities in fresh produce now?

We are always working on improvements in the value chain. Shelf life is very important to us and our customers are investing very heavily in coolers. In a country like Norway with long distances, quality and freshness are the highest priority.

What changes have you made in logistics?

One example is that we now have three drivers each on two trucks for our “Berry Express” from Morocco so they can arrive as fast and fresh as possible. From loading in Morocco to arrival in Oslo – before distribution in Norway – takes 3-4 days.

What is the “BAMA Commitment”?

For 15 years BAMA has adopted a dynamic and value chain–based model reflecting its desired holistic approach. Through detailed planning and predictability we aim for long-term, sustainable production and profitability in all stages.

Retail in Norway

logistics challenge: 5.1m people, 385,000 sq km

highly concentrated: soon just 3 main retail groups

about 3900 grocery shops, average turnover €5m

60% of grocers are discounters (highest in Europe)

0.8 grocery shops per 1,000 people (highest in Europe)

Norwegians shop 4 times pw

Norwegian F&V consumption (day/person)

2013: 443g

2006: 410g

BAMA Group (BAMA-Gruppen AS)

Est. turnover 2014: €1.65b up 9% on 2013)

7 business areas including food service & fast-growing flower business

2 retail customer groups in grocery business: NorgesGruppen & Rema 1000.

NorgesGruppen: 40% of grocery market, Norway’s biggest retailer

NorgesGruppen controls chains such as Meny, Kiwi, Centra, Joker & Spar.

Rema 1000: 28%, no-frills supermarket chain

BAMA also has representatives in Poland, Sweden & Holland

BAMA’s fresh produce

500,000 tons pa, of which:

72% imported (170 suppliers)

28% local production

serves 15,000 customers

BAMA’s fresh produce strategy includes:

Goal of min. 4% more growth pa in F&V than average for all categories

Focus on consumer — flavour & nutrition

Close relationship & long term cooperation with suppliers & customers

Importance of berries

300% volume growth in Norway since 2003

1% of Norway’s grocery sales

10.6 % of value of total F&V shopping basket at BAMA

30% of Norwegians buy fresh berries in a grocery store weekly

BAMA 2013 berry sales (in kg)

total 17 million

strawberries 10 million

blueberries 3.25 million (x12 in value since 2008)

raspberries 1.5 million

Cool chain investment

More coolers at checkouts

+3,000 new berry coolers in last 2yrs

+2,000 more in next 2 years

JB

Read this and other feature articles in Eurofresh Distribution edition 134