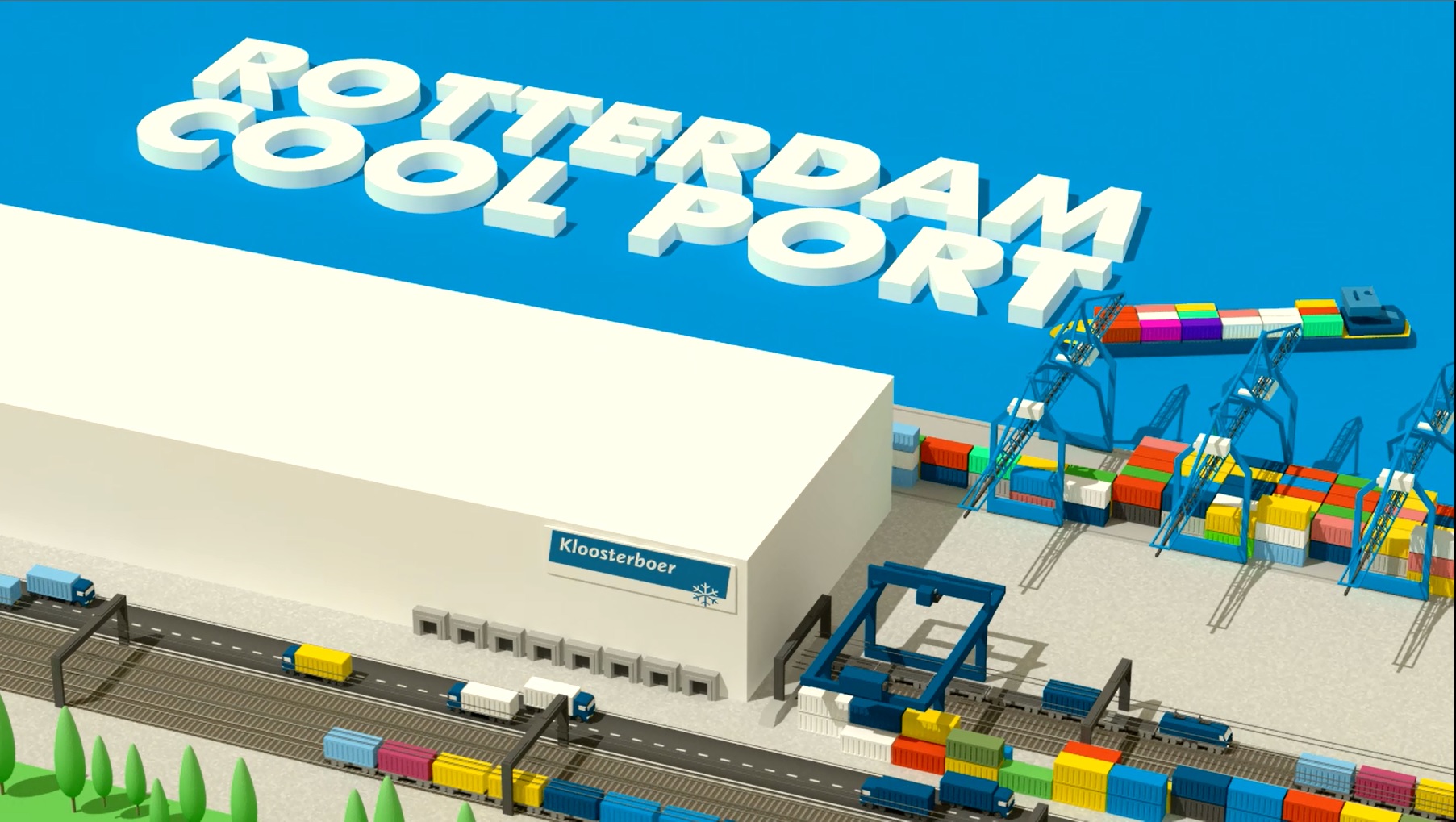

Kloosterboer and the Port of Rotterdam Authority are investing in the start of a new cold storage cluster on the City Terminal site in the Waalhaven/Eemhaven: Rotterdam Cool Port.

Kloosterboer is setting up a new cold store, specialised in the storage and handling of refrigerated and frozen cargo in reefer containers. Complentary services, such as empty depots and food inspection, will be added in the future.

“We are extremely proud about the start of Rotterdam Cool Port. We, as a port, have much experience in the cold storage sector and Rotterdam Cool Port is a valuable expansion of operations in this field,” said Ronald Paul, COO at the Port of Rotterdam Authority.

“As this location has many multimodal connections with the container cluster on the Maasvlakte as well as all surrounding Greenports and the final destinations in Europe, Cool Port will make a real contribution to the sustainability and efficiency of the supply chain for fresh produce,” he said.

Operational in 2017

Construction is due to start early next year on the cold store and the layout of the Kloosterboer site. The company is purchasing 5 ha with the option to expand in the future. The terminal is expected to become operational in the course of 2017, with a capacity of 40,000 temperature-controlled pallet spaces to handle at least 400,000 pallets a year.

There is an additional 14,500 m2 approx. to accommodate various services such as packing, sorting and cross-docking. “We are very pleased to have the opportunity to set up business at Cool Port. Here, we want to offer our clients the highest possible level of service in the perishable goods sector, via a state-of-the-art terminal,” said Kloosterboer CEO Hans Kroes.

Unique combination

The combination of location and cold storage facility makes Rotterdam Cool Port attractive, the port said in a press release. “Thanks to the location, shippers will no longer need to transport cargo from the terminal to the cold store, so that import and export costs can be substantially reduced. As Rotterdam Cool Port is being developed directly adjacent to container terminals, it will be possible to make optimum use of reefer container equipment. In addition, Rotterdam occupies a prominent position in the cold storage sector because the port serves as the first port of call in Europe for many shipping companies. Speed is crucial for perishable goods. Consequently, a whole range of specialised firms and temperature-controlled storage facilities have established themselves in Rotterdam and the surrounding area through the years,” it said.

Redevelopment

The Province and the Municipality have both granted a subsidy for the redevelopment of a large part of the Eemhaven, with the cool port considered a good use of the newly vacant land. The Province is also contributing towards the access-related infrastructure, in the interests of the Greenports. In addition, it will have a positive impact on employment in the area. It is expected that about 100 people will be working there by 2017.