Sainsbury’s to top Tesco with Asda merger

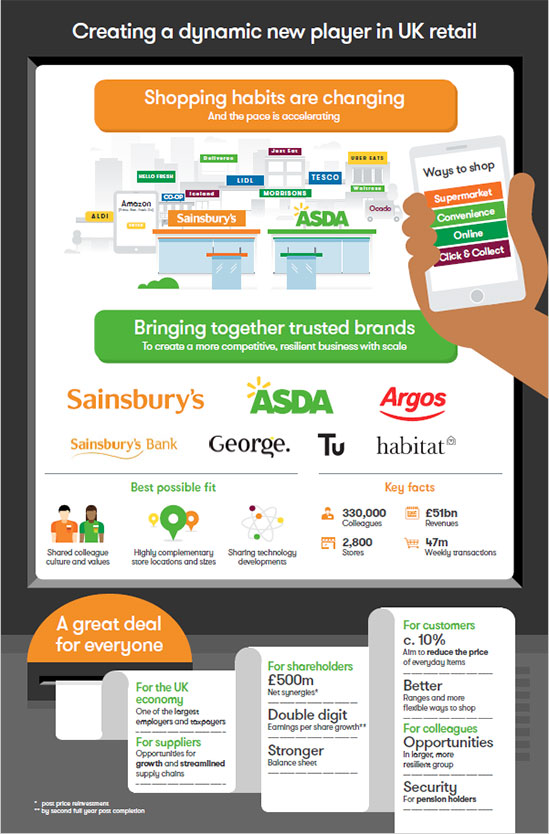

Sainsbury’s says its proposed merger with fellow UK retailer Asda would see prices drop by about 10% on many products and create “significant opportunities” for suppliers.

Based on their current shares of Britain’s grocery market, a merger between the second and third biggest supermarket groups would give the new business a 31.4% slice, overtaking long-time leader Tesco’s 27.6%.

In an April 30 press release, J Sainsbury plc said there are no plans for store closures as a result of the move and both the Sainsbury’s and Asda brands would be maintained and their distinctive customer propositions sharpened. However, Sainsbury’s CEO Mike Coupe later said some stores might be sold to other grocers if required by competition regulators. He hopes the deal will go through by the second half of 2019 and said it would benefit customers, staff, suppliers and shareholders.

The plan would create one of the UK’s leading grocery, general merchandise and clothing retail groups with a network totalling more than 2,800 Sainsbury’s, Asda and Argos stores and 47 million customer transactions a week. In the latest financial year, the revenue of the two companies together totalled about £51 billion.

source: Sainsbury’s (L-R: Sainsbury’s CEO Mike Coupe, Walmart International CEO Judith McKenna, Asda CEO Roger Burnley)

“The retail sector is going through significant and rapid change, as customer shopping habits continue to evolve. This has led to increased competition across grocery, general merchandise and clothing, as customers seek ever greater value, choice and convenience. Bringing Sainsbury’s and Asda together will result in a more competitive and more resilient business that will be better able to invest in price, quality, range and the technology to create more flexible ways for customers to shop,” Sainsbury’s said in the release.

Under the deal – which values Asda at about £7.3 billion – Sainsbury’s said it would give US retail giant and Asda-owner Walmart a 42% stake in the new, combined business and nearly £3 billion in cash. Walmart would not hold more than 29.9% of the total voting rights for the new group.

Analysts predicted the proposal would trigger a major competition inquiry and, if approved, result in some store disposals to ensure competition did not suffer. The plan was variously described in UK media as “the biggest shake-up in the market since Morrison bought Safeway in 2003” and a seismic shift which will transform the UK retail landscape. There were also reports of fears of job losses and that suppliers, particularly small ones, could be squeezed on prices.

Fraser McKevitt, head of retail and consumer insight at Kantar Worldpanel, said it was a pivotal moment for the British grocery market, one in which the German discounters Lidl and Aldi continue to enjoy strong growth. He also pointed out that Sainsbury’s and Asda supermarkets appeal to different customer bases. Asda achieves nearly two-thirds of its sales outside London and the south east of England in contrast to Sainsbury’s, which registers 59% of its sales in those two areas. Sainsbury’s also appeals to more affluent shoppers, he said.

sources include:

Sainsbury’s press release

Kantar Worldpanel news